georgia estate tax rate 2020

Before the official 2022 Georgia income tax rates are released provisional 2022 tax rates are. Tuesday August 16 2022 at 630 pm.

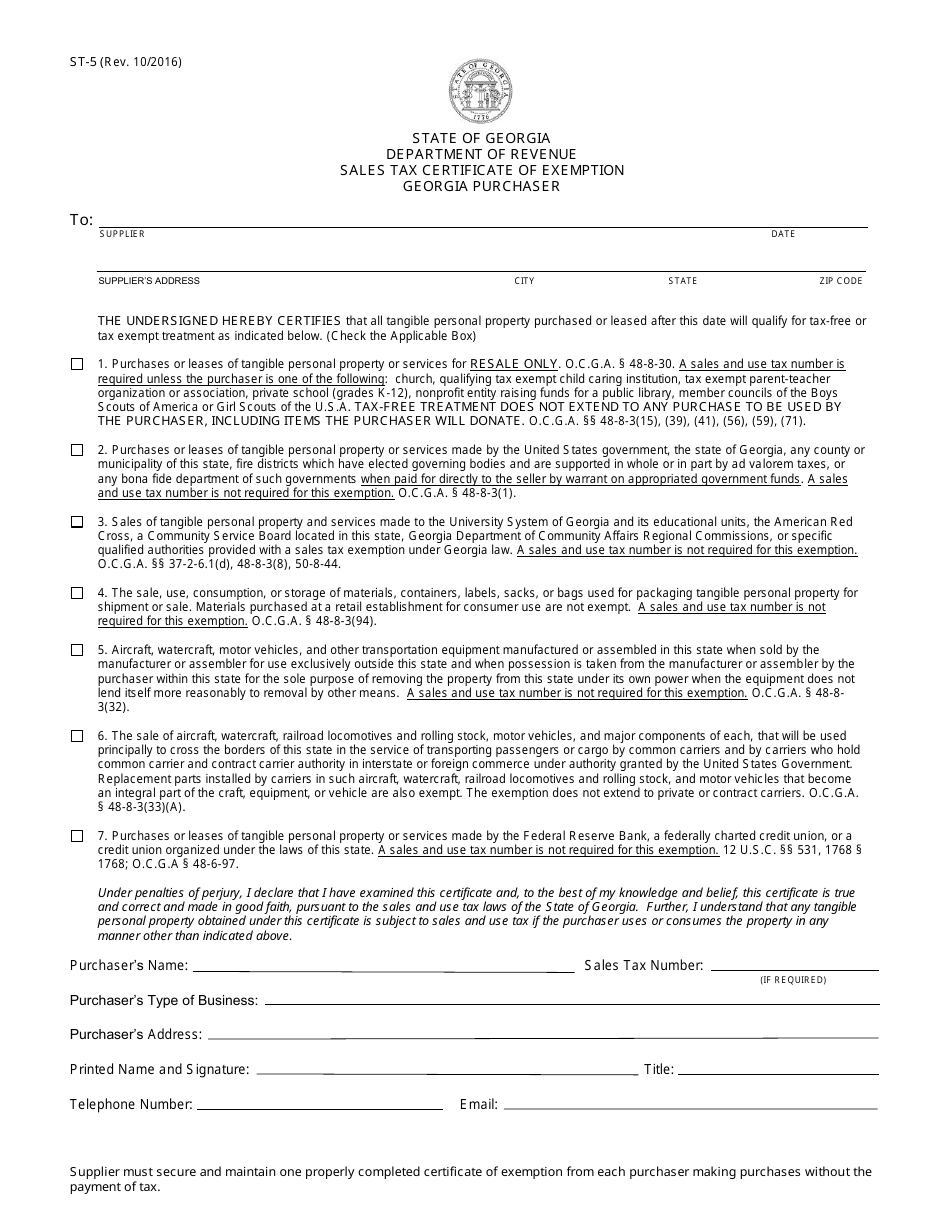

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Tax rate of 3 on taxable income between 3001 and 5000.

. Tax rate of 2 on taxable income between 1001 and 3000. We dont make judgments or prescribe specific policies. The highest marginal tax rate in the state at 575.

Depending on local municipalities the total tax rate can be as high as 9. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Georgia law is similar to federal law.

They are very different organizations. The state also charges a 575 percent corporate tax rate on Georgia. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Georgia is ranked number thirty three out of the fifty states in order of the average amount of property. For questions or concerns about the 2022 property tax millage rate please contact the Administration Office at 706-628-4958 Monday through Friday 800 am. The above income tax rates are for the 2021 tax year.

083 of home value. Georgia Governor Brian Kemp recently signed a tax bill that. Starting January 1 2020 economic nexus may be triggered by 100000 in sales or 200 transactions.

1158 million for 2020 117 million for 2021 and 1206. College Street Hamilton GA. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in. Georgia has six marginal tax brackets ranging from 1 the lowest Georgia tax bracket to 575 the highest Georgia tax bracket. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF.

Click through to find. Local governments adopt their millage rates at various times during the year. Information about Property Taxes Millage Rates and Car Tags.

The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County District MO Bond BANKS SCHOOL 14511 BANKS STATE 0000 BARROW AUBURN - BARROW 4931 BARROW BETHLEHEM 0000 BARROW BRASELTON 0000 BARROW CARL 0000 BARROW CID. One mill equals 100 of property taxes for every 1000 of assessed valuation.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. TY 2019 - 2020. Tax rate of 1 on the first 1000 of taxable income.

In Gwinnett County these normally include county county bond the detention center bond schools school bond recreation and cities where applicable. The Estate Tax is a tax on your right to transfer property at your death. For married taxpayers living and working in the state of Georgia.

Georgia Department of Revenue. All public hearings will be conducted in Room 223 of the Harris County Courthouse 102 N. Georgias income tax rates were last changed two years prior to 2020 for tax year 2018 and the tax brackets were previously changed in 2009.

The state of Georgia requires you to pay taxes if you are a resident or nonresident that receives income from a Georgia source. Property is taxed according to millage rates assessed by different government entities. Information about and links to both the Tax Commissioner and Tax Assessors Office.

See what makes us different. Property is taxed according to millage rates assessed by different government entities. Chatham County makes every effort to assure that the information presented on these web pages are up to date but to obtain the most accurate information you.

Georgia estate tax rate 2020. Tax rate of 575 on taxable income over 7000. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that.

The millage rates below are those in effect as of September 1. The IRS will start accepting eFiled tax returns in January 2020. Certain itemized deductions including property tax qualified charitable contributions etc.

48-12-1 was added to read as follows. Tax amount varies by county.

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Property Tax Calculator Smartasset

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Estate Tax Everything You Need To Know Smartasset

Taxes In Georgia Country Income Corporate Vat More

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Tax Rates Gordon County Government

308 Lakeshore Dr Savannah Ga 31419 Zillow

2021 Property Tax Bills Sent Out Cobb County Georgia